Credit card is a payment instrument functioning as a substitute for cash transaction. Consumers can use it to pay for products and services they purchase in merchants that accept credit card payments. Almost everybody has credit card, even more than one. How may credit cards do you have?

Besides making payments a lot easier to do, some errands are easily doable using credit card. For instance: online hotel booking, flight booking, or other online transactions. This fact certainly gives many benefits to customers, ranging from easy payment, low interest rate, to promotional and discounted prices. However, not all credit card holders know how to use credit card wisely so that one won’t pile up more debts. If you are smart and clever, you may gain maximum benefits from credit card through interesting promotion program.

Tips To Use Credit Card

Here are some tips to use credit card wisely so that you won’t get stuck in debts due to improper use of credit card:

-

Avoid making debts

Credit card is not a facility for loan or extra fund that banks provide freely. Understand that all transactions you do using credit card are debts you must pay off when credit card bill is due.

-

Avoid owning many credit cards

There is no use of having a lot of credit cards. Use only one or two credit cards from the best issuers that give many benefits.

-

Adjust credit limit with your salary

Baca Juga

Do not own many credit cards with credit limits that are way above your monthly income. It is extremely risky for your financial life, especially when you have difficulty to control expenses.

-

Close unnecessary credit card accounts

Close credit card accounts that are not or rarely used, and pick an account that gives the most benefits to you. Things to be considered include: interest rate that the issuing bank applies, promotions and features from the bank, various fees that you must pay, and also a range of advantages you can get.

-

Close credit card accounts gradually

If you have a plan to close several credit card accounts you already owned, do it gradually. Don’t close them all at the same time, as it will affect your BI checking or Historical Information of Individual Debtor (IDI History).

-

Don’t exceed credit limit

Use credit card within normal limit, that is around 40% of credit limit given by the issuing bank.

-

Choose credit card with the lowest interest rate

You can consider picking a bank that offers credit card with the lowest interest rate. This is mainly necessary if you usually do not pay off the whole credit card bills every month.

-

Pay off all credit card bills

Baca Juga

Make an effort to pay off all transactions and various credit card fees, especially annual fee. A number of debts and arrears will make your credit score look terrible in bank’s perspective.

Also read: Which One To Choose: All Risks or TLO Insurance?

Transactions Using Credit Card

Here are some examples of transactions that are easier and more profitable than cash transactions if you do them using credit card:

-

Economic shopping using credit card at supermarkets.

Many supermarkets nowadays cooperate with certain credit card issuers. Some of them even launch co-branded credit cards with several credit card issuers. They often promote 0% interest installment plan and offer cash back for all purchase, or 50% discounted price for special items.

-

Hotel booking is easier and cheaper using credit cart.

Special offers can be used when booking hotel rooms, particularly if you want to book those of star hotel. Your family vacation will be thrifty to the value of millions rupiah, depending on how big the promotion is.

-

Flight booking is safe and comfortable using credit card.

These days many airlines give incessant promotions and price cuts for credit card holders of certain banks because those airlines have business cooperation with the issuing banks.

-

Online shopping

Almost all shopping websites today prioritize credit card payments. There are even special offers for credit card holders, such as discount, low interest, 0% interest installment, and other promotions from some websites. All under one condition, that is online transactions using credit card.

-

Buying electronic equipments

Numerous retail shops give benefits if customers buy electronic equipments using credit card. For instance: interesting promotion, major discount, cash back program, and 0% interest installment.

Also read: Make The Right Calculation

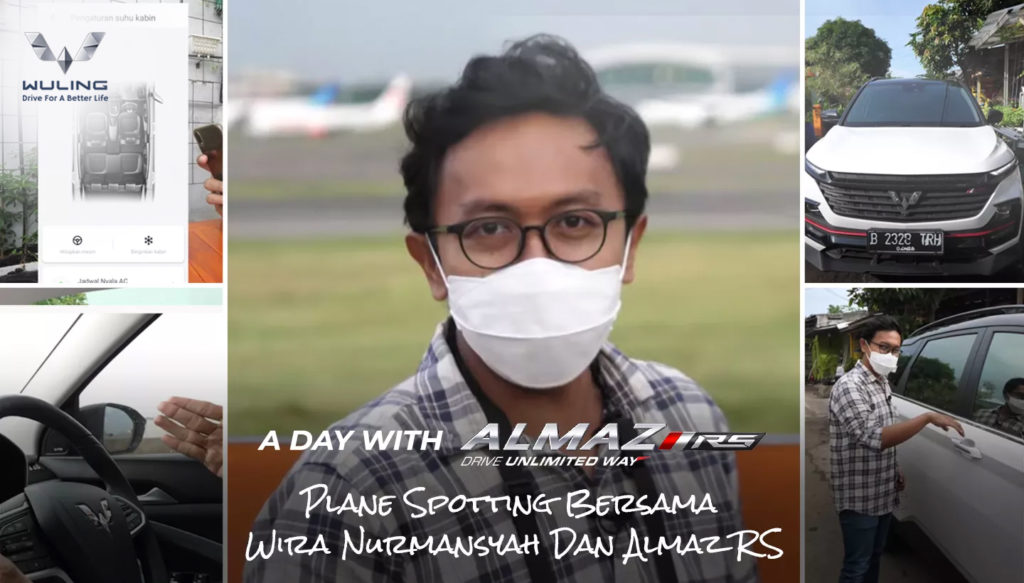

How you use credit card depends on your thinking pattern and lifestyle. Don’t get allured by various benefits that might drive you into reckless credit card use. Therefore, use your credit card wisely and pay off all the bills regularly. If you have a family and do not own a car yet, it is better to limit the use of credit cards for consumptive needs and start saving money to buy a car. Choose the MPV type because it can meet the needs of the family. To determine the quality MPV and competitive prices, you can choose Wuling.

SHARE: