Claiming insurance for your car is indeed not as easy as imagined as there are many steps that need to be taken. The first thing that needs to be prepared is the completeness of the document.

FIrst and foremost, you must ensure what are the required documents to submit your insurance claim. Avoid missing any documents so as not to hinder the process of making your claim.

Types of Car Insurance

To follow the procedure for claiming car insurance, you must first know the type of insurance you have. Not all car insurance will provide the same protection and the type of insurance will adjust to the choice when purchasing insurance products for cars.

The types of car insurance that are widely used in Indonesia are total loss only or TLO and All Risk or Comprehensive. TLO only makes a claim when the insured car is damaged by 75% or more. That being said, if the damage is less than 75%, the claim cannot be made.

TLO will usually apply to cars with a fairly severe level of damage, so it does not apply to cars with minor damage. The main advantage of TLO insurance is that it has very affordable premiums, so many people choose this type of insurance.

For those of you who buy a used car, of course it is very profitable when registering a car in TLO insurance. However, not all types of cars will get insurance protection, so you must inform the party who takes care of insurance so that the car gets the appropriate insurance protection.

However, not all types of cars can get this insurance protection. You must communicate as well to the insurance agent, in order to get the appropriate protection.

Baca Juga

All Risk insurance, on the other hand, is the type of insurance that provides comprehensive protection against various risks your car may experience. Minor to severe damage can get an insurance claim under this type.

If your car has very minor damage such as scratches, then an insurance claim can be made. All Risk has a fairly high premium, so it is very burdensome for certain groups. All Risk also includes the cost of expanding car insurance liability such as earthquakes, floods, tsunamis, terrorism and others.

Broken or scratched car insurance claims can usually only be made by vehicle owners who have an All Risk insurance policy. Broken or scratched cars are categorized under less than 75% damage. How to claim insurance for a broken or scratched car is the same as claiming All Risk insurance.

How To Claim Broken or Scratched Car Insurance

1. Preparing Documents

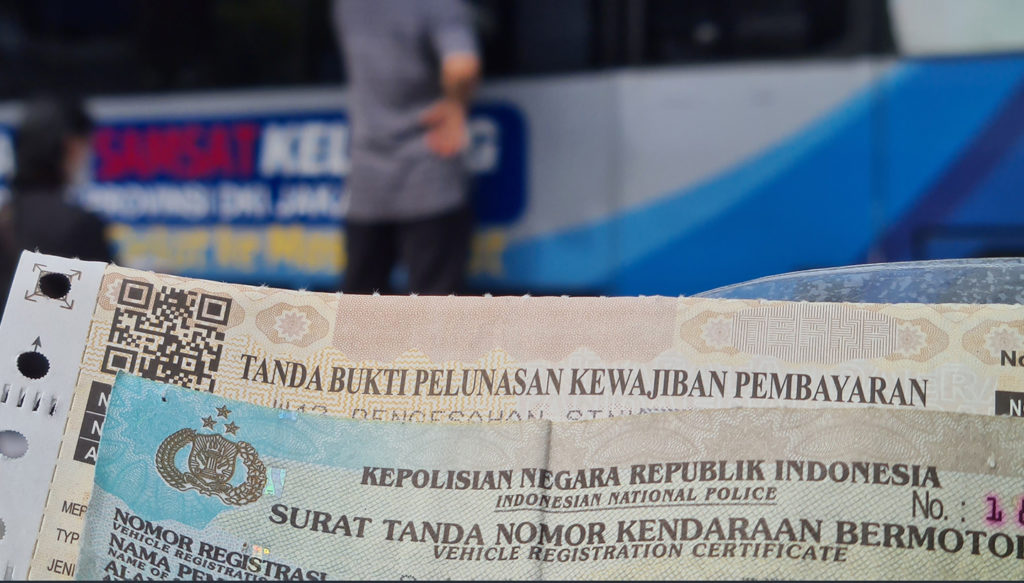

You are required to prepare various documents when making a Broken or scratched car claim. Make sure the documents are ready before you contact the insurance company. There are several important documents that must be prepared, including a copy of your driver's license, insurance policy, vehicle registration, forms for insurance claims and a certificate from the police, if the car is scratched or damaged as a result of a traffic accident.

2. Call The Insurance Office

After the documents are prepared, you can directly come to the nearest insurance branch office or contact the insurance first.

It's now easier to contact the insurance company by phone or email. Then you just follow the guidelines that will be explained by the officer related to the procedure for submitting an insurance claim.

3. Car Damage Photos

You must also prepare photo documentation showing the condition of the car that is broken or scuffed, so that you can immediately get an insurance claim. Please send a car photo file via the email address of the car insurance.

Baca Juga

You must also provide honest and clear information to the insurer, so that your claim submission is approved.

4. Fill out the Form

Make sure to fill out the registration form provided by the insurance and explain in detail about the damage to the car. By reading your explanation, the insurer will find out the cause of the damage that occurred to the car.

5. Third Party Documents

If the damage to the car is caused by the negligence of a third party, then you must prepare documents to obtain compensation. Please contact the insurance company to get detailed documents needed, so that you can file an insurance claim when there is a third party.

6. Visit Insurance Partner Repair Shop

You can also come or contact the repair shop that has collaborated or become a partner of the insurance company. Then you can directly fill out the form that has been prepared by the repair shop.

If your insurance claim submission is successfully approved, you can immediately fix your car at the repair shop of the insurance partner.

Tips for Submitting An Insurance Claim To Avoid Rejection

Making an insurance claim should not be underestimated as quite often the process doesn’t run smoothly. There are several conditions that can cause an insurance claim submission to be disapproved as explained below.

1. Lapse Policy

A lapse or inactive policy will make the car insurance claim that you submit gets rejected by the insurer. This happens usually due to arrears in premium payments for months. If the condition of the policy is not active, the insurer will be reluctant to pay the insurance claim.

2. Previous Damage

When your car has been damaged before filing an insurance claim, you will not be able to get a claim. You must register an insurance claim when the car is in top condition, so you can use insurance when there is damage to the car.

3. Applicable Rules are Violated

Insurance claims will usually be rejected if you violate the applicable traffic rules. These violations include parking in inappropriate locations and drinking alcohol while driving. If you drive recklessly and an accident occurs, the insurance claim can be denied.

4. The Policy Is Not In Waiting Period

The waiting period will usually last for a month after the car insurance policy is issued. Car owners cannot file insurance claims during the waiting period. If the car is already damaged, the insurance company will not provide an insurance claim.

5. Accidentally Damaged Car

A car that is damaged intentionally will not get an insurance claim. Car damage is usually the result of accidentally crashing a car with another car or hitting it on purpose. Deliberate conditions will prevent you from getting an insurance claim.

6. Unreported Additional Accessories

When you add car accessories, you should report it to the insurance company by attaching the coverage value. This will apply when you make an insurance claim, so you can get cover directly from the insurance.

7. Incomplete Documents

If you submit an insurance claim with incomplete documents, the insurance application will be 100% rejected. We recommend that you prepare the necessary documents properly, so your claim can be obtained quickly and without issue.

SHARE: