7 Ways to Save Money to Buy Your Dream Car for Young Adults

Gone are the days when owning a car was a luxury reserved for the wealthy. Nowadays, more and more young adults have a dream of owning their own dream car. But how do you save up to buy your dream car, especially with a limited income?

Let's face it, buying a dream car is not easy, especially for young adults who are still in their productive years with limited income. Therefore, to be able to buy your dream car, you need to make a consistent effort to save money.

So, how do you do it? This article will discuss seven ways to save money so that you can buy a car at a young age, particularly if you are a productive young adult between the ages of 20 and 35.

1. Determining Your Dream Car Target

The first step in quickly saving up to buy your dream car is to determine the target price. When determining the car target, it is important to consider the car features that support our needs and activities as young and productive workers.

One affordable car option for young people is the Alvez. A modern SUV that means "All At Once" with the concept of Style and Innovation in One SUV combines stylish and sleek exterior and interior designs. In addition, it is supported by innovative features such as an integrated safety system for a more peaceful journey while driving this compact SUV.

Baca Juga

This car has modern features and suits the lifestyle of young people, including audio streaming and Bluetooth connectivity features that make it easy to manage music and connect smartphones with the car.

2. Create a Savings Target for Your Dream Car

After determining the dream car target, the next step is to create a savings target to buy the car. Determine the savings target according to the desired car price, but do not force yourself so much that it makes it difficult to meet daily needs.

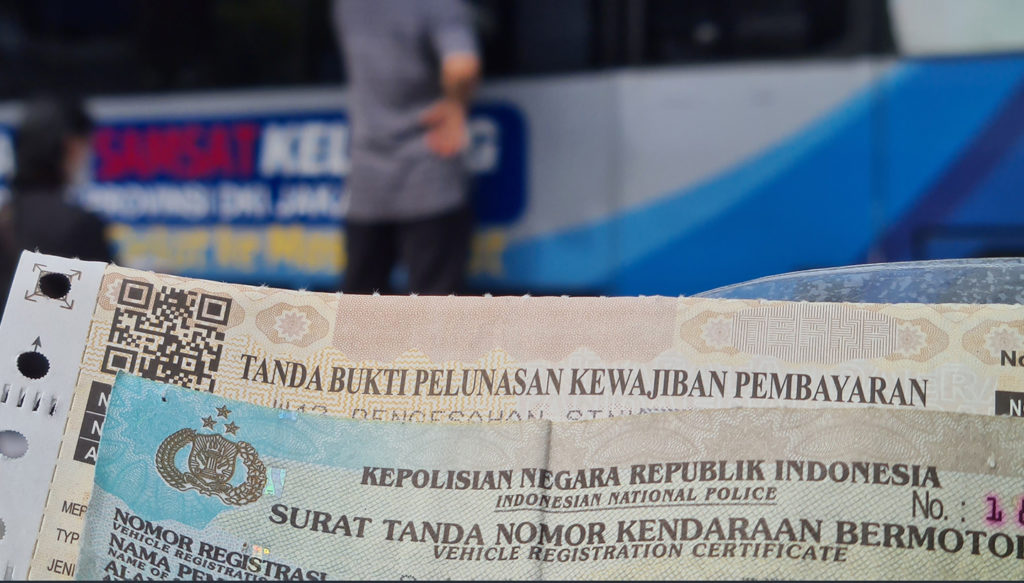

In addition, it is also important to consider additional costs such as car insurance, taxes, and maintenance costs. When determining the savings target, we can also consider the option of buying a car on credit or through installment plans.

3. Create a Monthly Expense Budget

To effectively save money, it is important to create a detailed monthly expense budget. In creating a budget, we need to differentiate between needs and wants.

Baca Juga

Prioritize needs such as household expenses, transportation, and other living expenses. Reduce expenses for wants, such as dining at fancy restaurants or buying unnecessary items. By calculating expenses in detail, we can determine which expenses can be reduced so that we can allocate more money to save.

4. Find Additional Sources of Income

To speed up the saving process, you can look for additional sources of income besides your monthly salary. This additional income can come from various sources, such as a side business, freelance work, or even selling unused items. This step can be considered effective as a way to save up for a car with a small salary.

However, before looking for additional sources of income, make sure that your main job is not disrupted and can still be run well. Don't let additional income make you tired or disrupt your actual main job. Choose a side job that suits your expertise and does not require too much time, so that you can still focus on your main job and save up for your dream car.

5. Save Your THR and Year-end Bonus

Getting THR or year-end bonuses from your company is indeed enjoyable. However, don't get too carried away with the extra money. Instead of immediately spending the money, save your THR and year-end bonus to buy your dream car. Additionally, you can also invest the money to earn more profits in the future.

Before saving or investing, don't forget to have a solid financial plan. Determine the amount of money to be set aside for saving or investing so that you are not tempted to spend the money on unnecessary needs. By doing so, you can ensure that your bonus money is well spent and helps you achieve your long-term financial goals.

6. The Importance of Emergency Funds and Insurance

Emergency funds can be a lifeline in times of urgent need or unforeseen circumstances that require immediate financial assistance. On the other hand, insurance can protect you from future financial risks such as illness, accidents, or car damage.

Make sure to prioritize saving for emergency funds and paying insurance premiums regularly to ensure you have adequate financial protection. Don't let your dream of owning a car compromise your financial security.

7. Consider Buying a Used Car

If you're looking to buy a car at a cheaper price, then buying a used car can be a solution. Although a used car has had a previous owner, there are still many used cars in good condition that can last a long time. However, before buying a used car, make sure to inspect it first. Check the engine, body, chassis, and interior of the car. Also, make sure to buy a used car from a trustworthy seller who provides a guarantee or warranty for the car.

***

Purchasing a dream car can be the aspiration of many people, especially young adults. However, it takes strong determination and financial preparation to make that dream come true. By implementing these tips and preparing financially well, you will be able to more easily purchase your dream car in your productive years.

SHARE: